During times of economic malaise, discretionary income tends to decline. For many, it’s difficult to justify spending money on one’s appearance. Over the past several quarters, as consumers have cut back, investors have lost confidence in the aesthetics sector.

Among laser aesthetic companies, Palomar (PMTI), Cutera (CUTR), Cynosure (CYNO), and Candela (CLZR) have all seen significant declines in share price. In most cases, they’re trading near five-year lows.

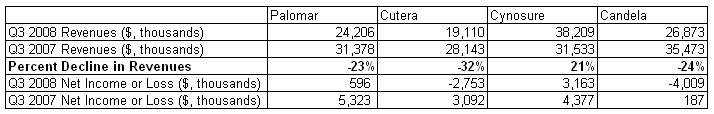

All have recently reported third quarter revenues. As expected, they’re showing signs of weakness. It’s not pretty, but for those with a longer-term perspective, they’re may be some bargains afoot. I suspect that the sector is oversold – this was certainly the case prior to last week’s rally.

A year ago, Candela had a market cap of over $100 million dollars; today, the company is worth $10 million and change. Considering the shear number of players in the industry, Candela’s revenues ($148 million in 2008) should be worth a lot to the right competitor, even with a lawsuit hanging over them. The company is currently exploring strategic alternatives.

Cynosure, profitable for eight consecutive quarters, seems comfortable navigating the challenging economic conditions seen throughout the aesthetics industry – but investors don’t care. Last week the company was trading in the $8-range, the lowest point in the company’s history.

Though it remains to be seen, I believe the laser aesthetics industry is about to experience significant consolidation, with Cynosure and Palomar leading the charge. Because products and segments overlap, consolidation would create substantial synergies in sales and marketing efforts. Consolidation could potentially relieve some of the pricing pressures now impacting revenues and gross margins.

Cynosure has $92.7 million in cash and investments with no debt. Palomar’s balance sheet is showing $128 million in cash and cash equivalents. Both are well positioned to buy competitors at a significant discount and benefit when economic conditions improve.