Healthcare has been one of the hottest sectors over the past year. This can be seen by looking at various ETFs such as iShares Dow Jones US Healthcare (IYH). This particular ETF has appreciated by approximately 35% over the past 52 weeks which is significantly higher than the 27% appreciation that the S&P Depository Receipts (SPY) has given investors. Now the healthcare sector is built up of many smaller industries and this article will focus on medical services companies which have produced strong quarterly results.

Healthcare has been one of the hottest sectors over the past year. This can be seen by looking at various ETFs such as iShares Dow Jones US Healthcare (IYH). This particular ETF has appreciated by approximately 35% over the past 52 weeks which is significantly higher than the 27% appreciation that the S&P Depository Receipts (SPY) has given investors. Now the healthcare sector is built up of many smaller industries and this article will focus on medical services companies which have produced strong quarterly results.

Companies Showing Strength

One such company with a strong quarterly earnings report is Lifepoint Hospitals (LPNT). Lifepoint Hospitals is a leading hospital company dedicated to providing quality healthcare services close to home. Lifepoint has nearly 60 hospital campuses in 20 states. The company tends to be the only provider in most of their communities. They also have more than 28,000 employees and 3,000 physician partners across the country.

Lifepoint has had a strong 3 months of trading, mostly due to their recent earnings report.

The company soared 4.6% after the earnings report and has been able to maintain that level since the report.

The company demonstrated after its last earnings report that it is in good shape for the future. Lifepoint filed its quarterly earnings statement on April 26, 2013. We can begin by looking at the company’s balance sheet. The first thing that stands out is the company’s excellent cash position. Over the past 3 months, Lifepoint was able to grow their cash available by 88.7% from $85.0 million to $160.4 million. At the same time, Lifepoint’s long-term debt remained relatively constant. The one concern would be the amount of long-term debt that is coming due during this year. The company may need to engage in additional financing or a secondary to help pay that down, in addition to using their available cash. On the income statement, the company also made great progress. Compared to the same quarter in 2012, Lifepoint’s revenue increased by 10.2% to $1.1 billion. Additionally, analysts are expecting the growth to continue in 2013 and 2014. For 2013 and 2014, analysts are expecting growth rates of 8.4% and 5.8%, respectively.

Now the company is certainly not without its fair share of risks. The first concern, as already pointed out, is the amount of debt coming due this year. However, the company’s market cap sits comfortably at over $2 billion, so if necessary, the company could likely engage in additional financing or issue a secondary to help pay it down. The company also has a very strong cash position to help with that. A second risk is ObamaCare. ObamaCare will likely punish hospitals with high readmission rates. For hospitals that fall in this category, Medicare will reduce reimbursements by as much as 1 percent. The penalties increase from that point on. There is no reason to think that Lifepoint falls in that category but since this new rule will likely punish 67% of hospitals, it certainly could.

Another hospital company which produced an excellent quarterly earnings report is Kindred Healthcare (KND). Kindred Healthcare operates long-term acute care hospitals, impatient rehabilitation hospitals, nursing and rehabilitation centers, assisted living facilities, and a home health and hospice business across the United States.

Much like Lifepoint, the company has had a strong recent trading trend, thanks in large part to their recent quarterly earnings report.

The company filed their quarterly statement on May 1, 2013. Since then, the share price has soared by more than 17%. Although the 2 year chart is certainly ugly, the company appears to be making a comeback and is just shy of its 52 week high of $12.76.

Financially speaking, Kindred performed extraordinarily well. The company’s cash position did decrease by roughly $7.3 million to $42.7 million. However, the company was able to keep its long-term debt relatively stable at $1.67 billion, an increase of just $22.5 million. On the income statement, the company grew its revenue by 1.1% to $1.55 billion. A few key takeaways from the earnings report are as follows:

– Solid cost management drove core operating income growth of 6% and EPS growth of 14%

– Core operating expenses increased only 0.3% compared to the same quarter last year

– RehabCare revenue growth and higher therapist productivity drove 30% growth in operating income

– Home health and hospice division saw a revenue increase of 82% and an operating income increase of 55%

– GAAP operating cash flows grew to $25 million compared to last year’s deficit of $3 million.

Kindred has done a great job of improving its financials to help reward shareholders and take the company to the next level. That being said, the company faces uncertainty with ObamaCare. Much like with Lifepoint, it is unclear if the stricter rules will have an impact.

A third company in the industry which had an excellent quarter is Greenestone Healthcare Corporation (GRST.OB). Greenestone Healthcare operates medical clinics in Ontario, Canada. The company offers various medical services, including addiction treatment, endoscopy, minor cosmetic procedures, and executive health care services.

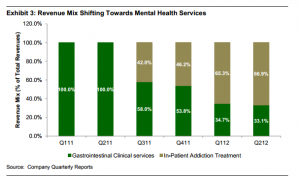

The dominant part of Greenestone’s business for most of its operating history has been endoscopy services. However, starting in July 2011, when the addiction treatment facilities were added, this business segment has quickly grown to generate most of the company’s cash flows. An analyst from Jacob Securities predicts that these cash flows will continue to have higher margins, and remain the company’s primary focus.

This shift paid off when Greenestone reported its annual report on April 2, 2013. Starting with the balance sheet, Greenestone reported an increase in accounts receivable of 102% from $188,423 to $380,043. Additionally, the company’s total current assets increased by 75% from $289,864 to $507,426. As good as the balance sheet looks, the income statement is where Greenestone really shined. For 2012, the company reported a revenue increase of 230% to $5.5 million, compared to just $1.68 million for 2011. Greenestone was also able to improve its net income loss as compared to 2011. For 2012, the net income came in at a loss of $1.55 million. In 2011, the loss was $2.46 million.

The increase in revenue was mainly due to an increase in business volume. Greenestone believes that revenue growth will continue to increase and its profitability will continue to improve since most of its costs, such as rent and salaries are relatively fixed. As revenue continues to grow, the costs will end up becoming a smaller percentage of that overall number.

The future certainly looks bright but will depend on a few upcoming catalysts. First, the company’s greatest margins are in the mental health facilities. This is particularly true of the Muskoka facility. Greenestone management estimates that it can generate between $27,000 and $74,000 in additional revenue for each additional patient that is admitted to the Muskoka facility. This will allow the company to increase cash flows from only a slight increase in capacity utilization at this facility in the near-term. Additionally, there is the possibility of future acquisitions of existing facilities. Late last year, the company announced its intention to pursue a “Build and Buy” growth strategy that will increase its in-patient capacity. This could result in substantial accretive earnings in the next several quarters.

Now while the earnings report and future catalysts sound great, the company is not without risk. First, it does trade on the bulletin boards, and as such, is subject to volatile price movements and market manipulation. An additional risk is future financings. Since the company is not yet profitable, cash to pursue the “Buy and Build” growth strategy will need to come from somewhere. The likely culprit will be additional financings in the future which could come from loans and/or secondary offerings. That being said, despite the risks, the company has a lot of potential based on their recent earnings report and upcoming catalysts.