When I first learned of NeuroMetrix, it was love at first sight. The company’s NC-stat System made it possible for physicians to diagnose neuropathies at the point of care, leading to faster diagnosis and earlier, more effective therapy.

When I first learned of NeuroMetrix, it was love at first sight. The company’s NC-stat System made it possible for physicians to diagnose neuropathies at the point of care, leading to faster diagnosis and earlier, more effective therapy.

At the time, the company believed in-office testing could expand the market for nerve conduction studies to as many as 9.5 million procedures annually, creating a $1 billion opportunity. The cash-generating consumables, mainly disposable electrodes, are the stuff medical device dreams are made of.

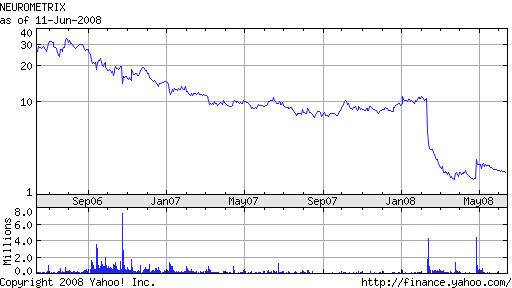

But like many relationships, my love affair with NeuroMetrix devolved into a heightened dramatic episode. Questions were raised about the marketing of the NC-stat System and about the potential for misuse by unqualified personnel. These issues prompted some insurance carriers to alter their categorization of the procedure, disrupting reimbursement. Sales at NeuroMetrix have stagnated and declined.

In the wake of this disaster, the company has launched the Advance System. Advance is a platform for performing nerve conduction studies and invasive electromyography procedures. Advance distinguishes itself with its low cost, small size, high capacity lithium-ion battery, and embedded amplification and digitization hardware, which reduce the potential for electrical interference.

In the post-coital aftermath of Advance’s 510(k) approval, the company’s share price nearly doubled to a high of $3.06. This excitement has faded as investors look for earnings to justify the share price. Such justification might be on its way.

According to an announcement released yesterday, initial sales of Advance have begun to materialize, supported by a direct U.S. sales force of 35!

Shai Gozani, President and CEO of NeuroMetrix, is “pleased with the initial response from neurologists, physical medicine and rehabilitation (“PM&R”) physicians, and hand surgeons.”

With that said, I’ll wait for next quarter’s results. Even with a promising product, in this economy, an investor’s love is not unconditional. NeuroMetrix will need strong earnings to support its sizable sales infrastructure. The company lost $10.8 million in its most recent quarter.