First Quarter Results:

Revenues at Candela Corporation, a maker of aesthetic lasers, decreased 24 percent year-over-year, to $26.9 million in the most recent quarter from $35.5 million last year. The decrease in revenues took its toll on the bottom line: the company reported a net loss of $4.0 million. In the same period last year the company had net income of $187,000.

While service revenues grew slightly ($9.6 million in the most recent quarter, compared to $8.6 million in Q1 2007), sales of lasers and other products dropped significantly. The company recorded $17.2 million in sales this quarter, compared to $26.8 million in the same period last year.

Gerard Puorro, Candela’s President and CEO, blamed challenging economic and business conditions in the laser aesthetics industry – though he expects things will get better with time.

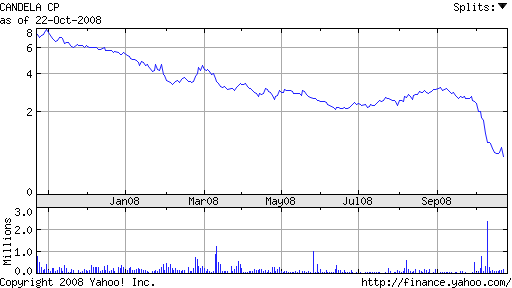

In light of the stock’s precipitous decline, the company has recruited Houlihan Lokey, an international investment bank, to explore strategic alternatives including (but not limited to) a potential merger. Given the shear amount of players in the laser aesthetics industry, I believe Candela’s business could be worth a lot more than $13.5 million (today’s market capitalization) even with a lawsuit hanging over them. Says Puorro,

“Our financial results are a reflection of these very challenging economic and business conditions, but we do not believe the current share price appropriately reflects Candela’s operational or financial position, including a brand that we have established as the gold standard in the aesthetic laser market over the last 20 years. We believe that we possess some of the best employees and distribution partners in the industry, and we are committed to acting in the best interest of all of Candela’s constituents.”

Previously: Palomar vs. Candela, Laser Battle Heats Up