Endologix, developer of a treatment for abdominal aortic aneurysms (AAA), saw revenues increase 42% in its third quarter. The company reported $9.4 million in sales and expects “at least” $10 million in fourth quarter revenue. If all goes to plan, Endologix is on track for full-year sales growth of 38% or more.

It’s been nothing but sunshine and roses for the company, which is now considering a $98 million buyout from hedge fund Elliott Associates. Endologix has received two new FDA clearances in as many weeks, further positioning the company for long term growth.

During the third quarter the company significantly improved its liquidity position and remains confident that it will begin generating positive operating cash flow in the first half of 2009.

For the nine months ended September 30, 2008, total product revenue increased 41% to $27.0 million, compared with $19.1 million for the nine months ended September 30, 2007. Total operating expenses for the first nine months of 2008 were $30.0 million, versus $24.6 million in the same period last year.

The company has $9.0 million in cash and cash equivalents on hand. During the third quarter of 2008, Endologix drew $2.0 million from its $5.0 million revolving credit facility and $3.0 million from its term debt facility. Says CFO Bob Krist, “Although we believe our cash was sufficient to reach positive cash flow from operations, we decided to draw on our available credit because of the unprecedented upheaval and uncertainty in the world credit markets.”

The company has $9.0 million in cash and cash equivalents on hand. During the third quarter of 2008, Endologix drew $2.0 million from its $5.0 million revolving credit facility and $3.0 million from its term debt facility. Says CFO Bob Krist, “Although we believe our cash was sufficient to reach positive cash flow from operations, we decided to draw on our available credit because of the unprecedented upheaval and uncertainty in the world credit markets.”

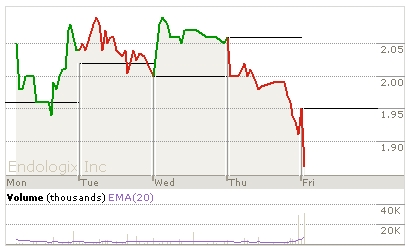

Despite the slate of positive news, in trading this week, Endologix stock has trended down slightly. One would think investors would flock to the company. Its AAA treatment is uniquely positioned to grow, even in the midst of a recession, unlike some aesthetics companies now running for cover.