Regular readers will know I’m bullish on AngioDynamics. Yesterday, the Queensbury NY-based company reported better than expected quarterly profit, buoyed by strong sales in its interventional product line.

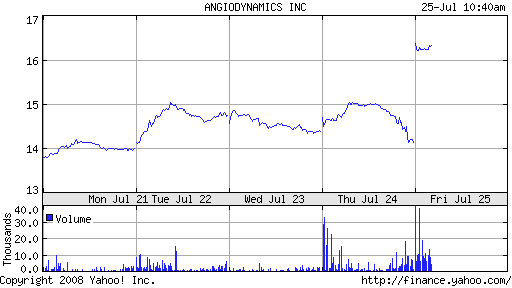

The news sent shares soaring 15% to $16-plus. AngioDynamics’ stock had traded as low as $10 in March.

Net sales in the fiscal fourth quarter were $46.8 million (analysts were expecting revenues of $45.8 million, according to Reuters estimates), a 14% increase over the $40.9 million reported in the fourth quarter a year ago. Gross margin rose from 58.9% to 62.7% in the same period. Net income was $519,000.

The patent litigation settlement with VNUS Medical, announced in June, reduced fourth quarter operating and net income by $6.8 million and $4.2 million respectively. Excluding this charge, operating income was $7.1 million and net income was $4.7 million.

Fiscal Year 2008

For fiscal year 2008, net sales were $166.5 million, 48% higher than net sales in 2007. Fiscal year 2008 included a full year of sales from RITA Medical, acquired by AngioDynamics in January 2007.

In April, the company completed the acquisition of Diomed’s assets. This should strengthen AngioDynamics’ position in the varicose veins treatment market.

In May, AngioDynamics acquired Oncobionic’s Irreversible Electroporation (IRE) technology. The company has begun the initial phases of its roll-out plan for an IRE technology-based product, NanoKnife. The first human clinical use of NanoKnife took place in April and was “extremely successful” – according to the company. A clinical trial is scheduled to begin shortly in Italy; additional patients are being treated in Florida.

Looking Forward

According to Eamonn Hobbs, President and CEO, “During the upcoming fiscal year, [AngioDynamics] will be making substantial investments in the development of NanoKnife, especially in clinical trials designed to generate data on the broad applications for Nanoknife in surgical resection.”

The company’s outlook for fiscal 2009 is as follows:

- Net sales in the range of $205-$210 million

- Gross profit in the range of 60-61% of net sales

- GAAP operating income in the range of $21-22 million

In 2010, AngioDynamics expects sales growth to approach 20% over fiscal 2009, R&D expense to return to 8% of sales, and operating income as a percentage of net sales to improve by 2-4% due to operating efficiencies.