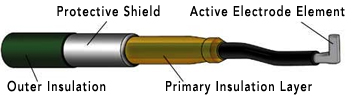

Boulder, CO-based Encision offers electrosurgical devices and laparoscopic instruments that incorporate active electrode monitoring or AEM. The technology continuously shields and monitors monopolar laparoscopic instruments during surgery to prevent stray energy burns, but is otherwise comparable to competing monopolar instruments in use and cost.

There is a well documented risk of unintended electrosurgical burn injury during laparoscopic surgery; inadvertent collateral tissue damage often occurs outside of the surgeon’s (limited) field of view.

This week the company launched an improved version of its EnTouch handles for its AEM articulating laparoscopic instruments, with a greater focus on ergonomics. Encision introduced enTouch in 2006. Handle sales were responsible for 10% of revenues in 2007.

The new ES8200 and ES8200L handles feature a stiffer shaft design to accommodate the stresses generated by organ manipulation during advanced and routine laparoscopic procedures. EnTouch model ES8200 is 35cm in length for normal size patients while the ES8200L is 45cm in length for large patients and many bariatric procedures.

The introduction comes at a time when the company is striving to enlarge its customer base. When a hospital changes to AEM technology, Encision generates recurring revenues from the sale of replacement instruments. The replacement market of reusable and disposable AEM products in hospitals accounted for 90% of Encision’s sales over the past three months.

The company has announced its intentions to develop disposable versions of more of its AEM products in order to meet market demands and expand sales opportunities.

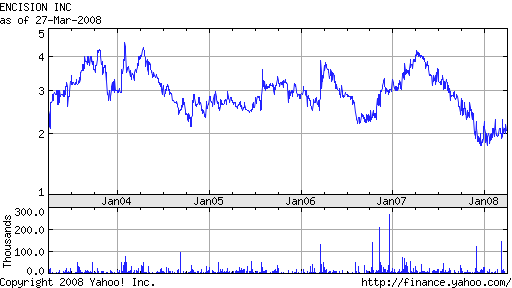

Encision has been growing steadily over the past three years, as it focuses on fundamentals and raising product awareness. From 2005 to 2006 revenues grew 11.7%. From 2006 to 2007 revenues grew 17% to $11 million. The company is not yet profitable, but it is close; Encision posted a loss of $131,000 in 2007.

Recommendations from the malpractice insurance and medicolegal communities complement the broad clinical endorsements AEM technology has garnered over the past several years. Encision has partnered with Novation and Premier, two of the largest Group Purchasing Organizations in the U.S. Together these firms represent some 3,000 hospitals and 50% of all surgeries in the U.S.

The principal downside at present is the company’s balance sheet. In December 31, 2007, Encision had $98,908 in cash on hand. The company borrowed $280,000 from its credit facility to fund operations. Encision has an accumulated deficit of $16 million.