Regular Sentinel readers know I’m a fan of Endologix. The developer of a minimally invasive treatment for abdominal aortic aneurysms has had a slate of positive news of late. In addition to two new FDA clearances, in its third quarter, the company significantly improved its liquidity position and is on track to begin generating positive operating cash flow in the first half of 2009.

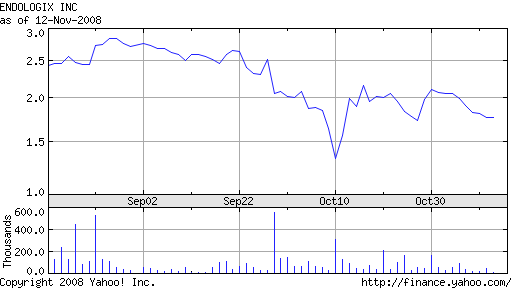

When the New York-based hedge fund, Elliott Associates, offered to buy Endologix for $98 million, or $2.25 per share, I described the unsolicited proposal as a ‘lowball bid’. Today comes news that the company’s board has rejected the proposal.

Commenting on that decision, John McDermott, Endologix’s President and CEO, said, “We believe that Elliott’s proposed valuation does not reflect recent FDA product approvals, increasing gross margin and our expectation of achieving positive operating cash flow in the first half of 2009. Additionally, we believe that volatility in the capital markets has negatively affected micro-cap companies like Endologix, and we expect the situation to improve in the future.”

Elliot Associates owns 14.5% of the Endologix’s common stock (3.6 million shares). I had hoped Elliot would agree to a buyout on better terms, but I remain confident that Endologix can deliver on its stated goals.