**The following comes to us from special contributor Johan Seijkens**

The landscape of healthcare is changing and whoever is smart will watch closely. With the introduction of Obamacare in 2013, the US stands to see a substantial increase in the number of insured individuals. And because the correlation between time and age has always been positive, Uncle Sam will be attending to millions of North Americans turning 65 yearly, their growing healthcare bill in tow.

The landscape of healthcare is changing and whoever is smart will watch closely. With the introduction of Obamacare in 2013, the US stands to see a substantial increase in the number of insured individuals. And because the correlation between time and age has always been positive, Uncle Sam will be attending to millions of North Americans turning 65 yearly, their growing healthcare bill in tow.

While the US moves towards a government dominated system, familiar in Europe and Canada, the latter are beginning to loosen the reigns, creating an interesting effect where the two systems shall meet in the middle.

After reading Bain and Company’s 2013 Global Healthcare Private Equity Report, I became interested in acquisition targets in the healthcare services field. One such target, Greenestone Healthcare Corp. is positioned well for growth, trading in the US while operating in Canada, where supplementary care is attractive and in high demand. The company could quite possibly be a diamond in the rough, easy to miss if you are not watching.

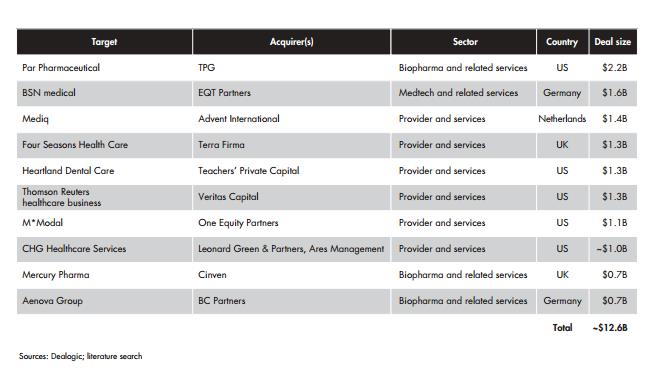

In total, $21 billion worth of private equity capital was invested in healthcare companies in 2012. The shape of deal activity shifted in 2012, with fewer mega-deals and more middle market deals. Interest in the healthcare provider and services sector outstripped other sectors in 2012.

Top 10 healthcare private equity buyout deals announced in 2012

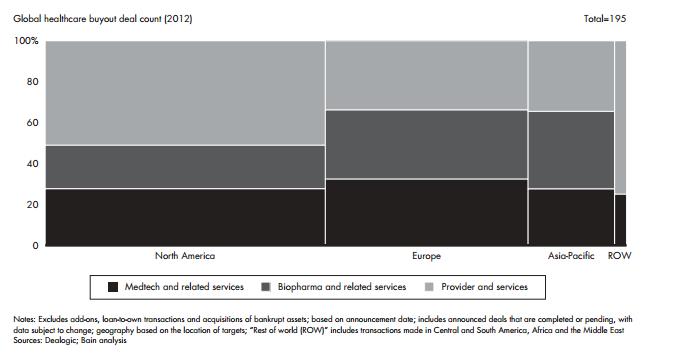

The provider and services sector leads North American buyouts, while activity is more evenly distributed in Europe and Asia-Pacific.

Macro Environment North America

Healthcare private equity buyout activity in North America is dominated by the US where both cost pressures and incentives to contain costs are robust. US-based employers, especially the larger employers that typically subsidize healthcare insurance for employees, have long been trying to contain their costs for pragmatic reasons. Legislative reforms—namely the Patient Protection and Affordable Care Act (PPACA)—are expected to accelerate the trend by creating more incentives for healthcare organizations and insurance companies to reduce costs themselves while improving outcomes.

For the most part, private equity investors in the US are looking to ride the trends that have been set in motion or accelerated by healthcare reform, such as cost containment, payment reform, new care-delivery models and hospital-physician alignment, without getting ensnared in the uncertainty about future reimbursement levels.

That theme has led to meaningful increases in the number of deals within the provider and services categories with more limited or indirect reimbursement risk, such as retail health, healthcare-related IT and outsourced services; however, an influx of new entrants in these “healthcare light” sectors is leading to increased valuations and trickier return equations.

Looking ahead, there is no question that healthcare investing remains attractive, thanks to the unique combination of stability and innovation it offers. Fortunately, some of the major drivers of themarket are trending in investors’ favor. Debt is cheap, making it easier to finance deals, and the hunting ground is large. At the same time, the stock market is rebounding and the appetite of strategic buyers remains strong, portending more and bigger exits. These are ripe conditions for investors with healthcare expertise t o achieve excellent returns if they choose the right opportunities.

o achieve excellent returns if they choose the right opportunities.

Within the provider and services sector that was so popular in 2012, consolidation opportunities should remain plentiful. Healthcare reform in multiple countries is intensifying the drive toward better outcomes at lower costs, such as in Canada, as more providers aim to get smarter about their operations, both in terms of supply chains and treatment outcomes.

Healthcare continues to be an attractive area not only for private equity investment, but also for private investors alike, thanks to its historically strong returns and low default rates.

The following three companies could be interesting acquisition targets going forward.

Vanguard Health Systems

Vanguard Health Systems, Inc. (VHS) is an operator of healthcare delivery networks with a presence in various urban and suburban markets. The company had 28 acute care and specialty hospitals with 6424 licensed beds with outpatient facilities and related businesses, which allow it to provide a range of inpatient and outpatient services in the communities it serves.

The company has about $6 billion in revenue and management. Blackstone, Morgan Stanley, and Capital Partners own 60% of the company. The stock trades around $15, with price targets between $15 and $18. Most analysts consider the company a BUY.

LifePoint Hospitals

LifePoint Hospitals (LPNT) was founded in 1999 and has grown to a leading hospital company with more than $3.5 billion in revenues and nearly 60 hospital campuses in 20 states.

The company’s fourth quarter revenues from continuing operations grew to $893 million, up 14% from the same period last year. EBITDA was $135 million, up 3.8% over last year and EPS was $0.76, exceeding the high end of the adjusted guidance range. And for the year, revenues from continuing operations were up 12% compared to 2011. EBITDA increased 1.8% over the prior year and EPS was $3.14.

During 2012, LifePoint completed three hospital acquisitions with over $400 million in annualized revenues. Management indicates that their acquisition pipeline remains very active.

During the past several years the company has taken a deliberate approach to invest in growth opportunities and maintaining a balanced capital deployment strategy. Since 2010, approximately $470 million was spent to acquire nine hospitals with approximately $700 million in annual revenues.

During this same time, the company invested $600 million in CapEx to support organic growth and quality initiatives and the company repurchased $400 million in stock, representing approximately 20% of LifePoint’s outstanding common shares.

Given LifePoint’s strong cash flow, the company can invest more going forward without increasing leverage.The stock trades around $45, with price targets between $36 and $48. Most analysts consider the company a HOLD.

GreeneStone Healthcare Corp.

GreeneStone Healthcare Corp.(GRST) is a Canadian healthcare company listed in the US focusing on mental health and behavioral treatment. The company is an attractive candidate to play the role of the next big healthcare sector private equity buyout target. The company has had early success building and operating a residential treatment facility, along with an outpatient and aftercare facility. With their 2013 expansion plans, GreeneStone is poised for its next major phase of revenue growth.

GreeneStone Healthcare Corp.(GRST) is a Canadian healthcare company listed in the US focusing on mental health and behavioral treatment. The company is an attractive candidate to play the role of the next big healthcare sector private equity buyout target. The company has had early success building and operating a residential treatment facility, along with an outpatient and aftercare facility. With their 2013 expansion plans, GreeneStone is poised for its next major phase of revenue growth.

The company operates in a highly underserviced sub-sector of the healthcare space that has been undergoing consolidation in the recent past. Private equity and strategic buyers have scooped up many of the available facilities in the US at valuations averaging $800K – $900K per bed. With many niche service areas still untouched (such as eating disorders), GreeneStone is capitalizing on this opportunity by opening complementary practice areas through a ‘buy and build’ growth strategy.

On April 2, 2013 the company released their 2012 results. For the twelve months ending Dec. 31, 2012, the company reported total revenues increase of 230% to $5,540,909, as compared to $1,678,804 for the same period in 2011. For the same twelve-month period, the company reported total net loss of ($1,553,797), or ($0.08) EPS, compared to ($2,462,288), or ($0.34) EPS for the same period ending in 2011.

This increase in revenue was mainly attributable to a steady increase in business volume since the company began operations. The company believes that revenue growth will continue to increase steadily and the company will become more profitable as most of its costs, such as rent and salaries and wages are relatively fixed, and therefore will reduce, as a percentage, as business and bed capacity volume grows.

Shawn Leon, President and Chief Executive Officer of GreeneStone Healthcare Corporation, commented, “The Company expected these operational results for the fiscal year 2012, and we anticipate even stronger growth in 2013 where we have all the reasons to believe that by the end of our second quarter the Company will be profitable.”

The ‘buy and build’growth strategy will lead to expansion in their current addiction treatment capacity to 184 beds from 36 beds through strategic acquisitions and internal growth.

Final Note

Healthcare in Canada is delivered through a publicly funded system that covers all “medically necessary” hospital and physician care, as well as prescription drugs for seniors, and curbs the role of private medicine.

While the system has widespread public and political support, costs have soared well above the rate of inflation and are expected to climb further as the baby-boom generation ages.

It is often stated that Canadian healthcare costs much less than American healthcare. This is of course a myth. Canadian costs are set per procedure. Hidden healthcare costs are high in Canada because of excessive wait times. The costs of under or non-performance at work due to these longer wait times are huge costs on employers and the economy, not to mention the individual patients who are laid up. These are the hidden factors that hide the massive cost of universal healthcare in Canada.

Changes are needed include more treatment of patients outside of hospitals – GreeneStone’s medical clinics are a great opportunity to play the healthcare field in Canada.

From a valuation point of view, Healthcare provides the most upside potential. GreeneStone currently trades at an implied per bed valuation of $160,000, a discount of 68% to the very conservative rate for facilities acquisitions of ~$500,000. The current valuation of $0.21 looks absurd and I think with the coming expansion plans the stock price could see a nice short term rebound to levels above $1.00. Current analysts target prices are around $5.

Private investors can still jump on the bandwagon before private equity steps in.