Minntech, a Cantel Medical subsidiary, will relocate its remaining Dutch manufacturing operations to the U.S. The move is designed to leverage existing infrastructure to lower overhead. The elimination of the Dutch manufacturing will lead to the discontinuance of on-site material management, quality assurance, finance and accounting, human resources and some customer service functions. The move should be complete by the end of 2008 and is anticipated to achieve annual pre-tax savings of $1,000,000 plus.

In connection with the relocation plan, Cantel anticipates incurring severance costs of approximately $550,000, asset impairment charges in the range of $200,000 to $300,000 and inventory write-down and other associated costs of approximately $200,000.

50-60% of these costs will be recorded in Q4 2008 with the balance recorded during the first four months of FY 2009. On the upside, Cantel intends to sell the facility in Holland; based on its appraised value, the company anticipates a gain on the sale of approximately $300,000.

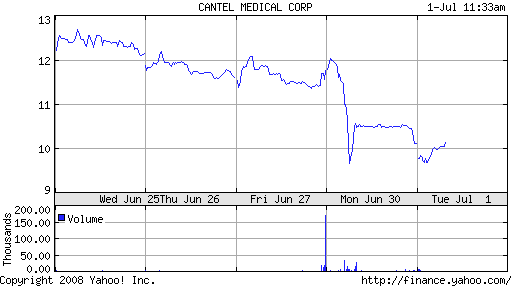

Despite the cost saving initiative, Cantel shares dropped 10% on the news. In June, Cantel reported lower third-quarter net income, primarily a result of higher production costs. Cost increases in raw materials and transportation are expected to have a negative impact on fourth quarter performance as well.

Blame a bear market for the precipitous fall-off. In the words of one investor, “stay in cash man, everything is junk”.