After battling for over a year to retain its AMEX listing, Signalife has thrown in the towel. The company will voluntarily withdraw its common stock from listing and trading on AMEX and will move to the over the counter bulletin boards.

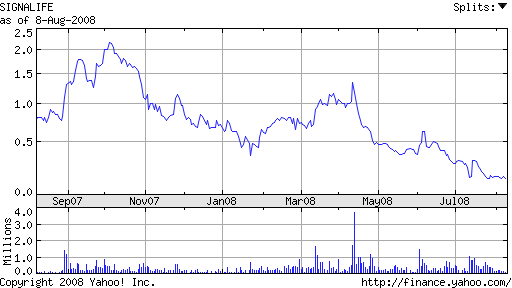

Signalife has experienced a precipitous fall in share price. The company traded as high as $2.20 this year. In January, the company hit $.33 when AMEX threatened and revenues failed to materialize. Signalife is now trading near a 52-week low of $.10.

The withdrawal will not impact the pending merger with Heart One Global Research (HOGR). That merger, announced in July, will combine HOGR, an Irish provider of electronic health record services and analysis, with Signalife.

Signalife’s ambulatory 12-lead ECG distinguishes the Fidelity 100 from competing heart monitors. The technology compresses and reduces noise prior to amplifying the ECG signal, eliminating the need to filter the signal after amplification. The improved quality of the data allows physicians to record full ECG signals from a patient during exercise or everyday activities.

Signalife put its best foot forward, saying “they are excited to move to a trading platform with greater historical predictability as this would provide the companies with a more cost effective, and competitive, place to grow.”

Signalife will avoid annual listing as well as the registration of additional shares from time-to-time, as well as uncertainties resulting from the prospective acquisition of AMEX by the Euronext exchange.