The AP has a tendency to turn any earnings misstep into a headline. Such was the case with yesterday’s news that “AngioDynamics 1Q profit slips on lower laser sales”. The Business Review said, “AngioDynamics reports 7.1% drop in 1Q net income.”

While true, by most measures, AngioDynamics first quarter was a resounding success.

Net sales were $44.3 million, an 18% increase year-over-year. Gross margin rose to 61.9% compared with 60.0% in the same period last year. Operating income increased to $3.8 million compared with $3.5 million a year ago.

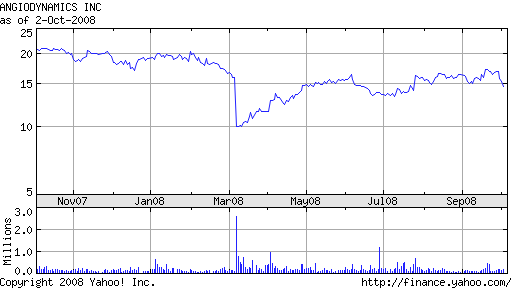

The fall in net income ($2.2 million in the first quarter, compared with $2.4 million in Q2 2007) can be attributed to the inclusion of certain Diomed assets beginning June 17, 2008.

Diomed’s customer base was reluctant to buy new lasers – understandably – until the long-term viability of the company was guaranteed. Sales dried up significantly prior to the acquisition. AngioDynamics lost about $1.5 million in Q1 as a result (there was also a supply issue that limited shipping).

“We inherited a bit of a mess,” said Eamonn Hobbs, AngioDynamics’ President and CEO. “It took us a large part of the quarter to start to see that turn around.”

In September, AngioDynamics began to see evidence of increased laser purchases as customer confidence was restored, even during the summer period – seasonally the slowest quarter for selling laser ablation products. Hobbs expects laser systems sales to grow as the year progresses. AngioDynamics hired 35 former Diomed employees and has integrated them into the company’s Peripheral Vascular business unit.

The company has cash and investments of $59.2 million on hand. AngioDynamics reaffirmed its fiscal 2009 outlook for net sales in the $205-$210 million range.